Okash Loan App: Everything you need to know 2023

Getting financial loans in Nigeria has become easier with the times, especially with the recent growth of Internet loan organizations.

These organizations provide their consumers with rapid, short-term loans without requiring any security.

Today, we’ll be looking into one of them, Okash, and learning everything we need to know about one of Nigeria’s top loan companies.

What is Okash?

OKash is a microfinance product offered by Blue Ridge Microfinance Bank.

Okash provides individuals in need of a soft loan with convenient low-interest-rate loans that do not require collateral.

The procedure is typically swift, with consumers obtaining loans in minutes, if not seconds.

It provides personal and commercial loans of up to N500,000. The app’s user interface and user experience are excellent, making it one of the top lending applications in Nigeria.

Individuals can download the OKash app from Google Play store and create their loan account in a few minutes.

Then choose their preferred bank account, add their active bank card for repayment, answer some questions, and receive a verdict on their loan application in minutes, all without using paper.

How does Okash work

Okash loans do not require any difficult information; all you need is your phone number and BVN and no collateral.

Using your BVN phone number, the Okash app checks your data and estimates your credit score.

To receive text messages, your phone number should be linked to your BVN.

Once all this is sorted, you can start requesting loans with no hassle.

Is Okash legit?

Of course, it is. Okash is a genuine business that is registered with the Central Bank of Nigeria.

They also have a physical branch in Ikeja, Lagos, where you can stroll in and make any queries

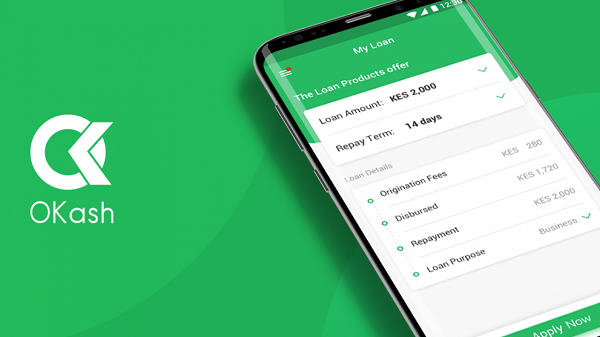

Okash Loan App

Installing the Okash loan app on a smartphone needs around 9MB of storage space. The installation should just take a few minutes.

The Okash app has been downloaded over 5 million times, which is rather remarkable.

The app has a good 4.3 out of 5 rating on Google Play.

Okash Loan USSD Code

The official Okash loan USSD code is *955#, and you may phone it from any Nigerian mobile network service provider.

The code ensures that you have a smooth experience as you transact on your account.

Okash Loan Requirements

Okash’s low-interest loans without collateral come at a cost. Before you can get a loan, you must first complete several requirements.

These prerequisites are as follows:

- You must be a resident of Nigeria.

- You must be between the ages of 20 and 55 to be eligible.

- You’ll need an Android device with a strong internet connection.

- Valid form of identification

- A valid bank account and a credit card are required.

What is the maximum loan amount I can borrow from Okash?

It varies depending on the individual, so please confirm that your information is correct and that you are applying with your mobile device.

But the highest amount on offer to any customer is NGN 500,000.

How to get an Okash loan

To obtain a loan from Okash, follow the steps outlined below.

- Install the Okash app from the Google Play Store.

- Create an account with your name, BVN, email address, and phone number.

- Navigate to your app’s dashboard and choose Apply for a Loan.

- Choose the loan for which you want to apply.

- Fill out the required information and apply.

- Following submission, you may be contacted for verification. The final application result will be displayed on the app, and you will be notified through SMS if you are accepted.

- Following loan approval, e-sign the loan agreement.

- Following the E-sign, the authorized loan amount will be sent to your account and an SMS message will be received.

Loan decisions are delivered in seconds, and applicants who are accepted receive monies in a few minutes.

The loans are made available through an Android mobile app, and lending decisions are made virtually quickly.

Okash Loan Interest Rate

Okash has a loan interest rate of 0.1%. The interest charged is 1.2% per day for a fixed term of 15 days.

Their interest rate is calculated daily. Annual Percentage Rate (APR) from 36.5% to 360%.

For example, for a 65-day loan payment term, the interest is 6.5%.

For the loan processed with a principal amount of NGN 10,000, the interest would be NGN 650, and the total amount due would be NGN 10,650.

Okash loan duration

Okash usually has a loan duration from 91 days at the lower end to 365 days at the extreme end.

Okash Loan Repayment

The following are some ways of paying back your Okash loan:

- Okash will auto-debit the due amount at the repayment date directly from your bank card. Make sure the card has sufficient funds before the due date to avoid any issues.

- You can pay via the App by clicking “Make a Repayment” on the ‘My Loan’ page in the app.

Their loans are made possible through a collaboration with Blue Ridge Microfinance Bank.

You can pay or transfer to Blue Ridge Microfinance Bank Ltd if you are unable to repay your loan by direct debit.

Bank Name: Zenith Bank Plc.

Account Number:1130085518.

In the remarks section, include your Bank Verification Number or registered phone number, as well as your entire legal name.

After the transaction has been completed, you must email evidence of payment to [email protected] to validate the details and modify your loan status.

As previously stated, Okash deducts your loan from your balance automatically as long as you have a sufficient balance in your account.

This implies you don’t have to go through the payback stages outlined above.

Late Repayment Penalty

Late loan repayments automatically incur a 2% per day rollover interest charge. It is consequently recommended that the payback duration not be exceeded.

This may also lower your future borrowing credit score.

Okash Customer Care

If you want customer support and need to interact directly with Okash, you may do so through any of their several customer service channels.

You can contact them by phone at 018884549 or by email at [email protected].

You might also visit their physical location, which is located at Room 301, Japaul House, Plot 8 Dr. Nurudeen Olowopopo Way, Central Business District, Ikeja, Lagos, Nigeria.

They also have social media platforms on Twitter and Facebook. You can check those out as well.