When it comes to taking out a loan, borrowers often focus on the interest rate and monthly payments. However, there are other factors that can impact the total loan balance. Understanding these factors can help borrowers make informed decisions and avoid unnecessary costs.

One of the most significant factors that can increase a borrower’s total loan balance is interest. Interest is the cost of borrowing money, and it can add up quickly over the life of a loan. Borrowers should pay attention to whether their interest rate is fixed or variable, as variable rates can fluctuate over time and lead to higher costs.

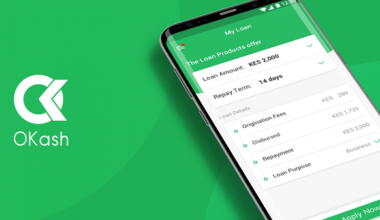

Another factor that can increase a borrower’s total loan balance is fees. Some loans come with origination fees, application fees, or prepayment penalties. These fees can add up and increase the overall cost of the loan. Borrowers should read the fine print and understand all fees associated with the loan before signing on the dotted line.

Understanding Loan Balance and Repayment

Components of Loan Balance

When a person borrows money, the amount that they owe is referred to as the loan balance. The loan balance consists of the principal amount borrowed plus any interest and fees that have been added to the loan. For example, if a person borrows $10,000 and the interest rate on the loan is 5%, the loan balance will increase by $500 each year. If there are any fees associated with the loan, such as an origination fee, the loan balance will increase by that amount as well.

The Repayment Process

When a person takes out a loan, they agree to repay the loan over a certain period of time. The repayment period is known as the loan term. During the loan term, the borrower makes monthly payments to the lender. Each payment consists of a portion of the principal amount borrowed plus any interest that has accrued since the last payment. The borrower must continue to make these payments until the loan is paid off in full.

The repayment plan for a loan can vary depending on the lender and the type of loan. Some loans require the borrower to make minimum payments each month, while others require the borrower to pay off the entire loan balance by the end of the loan term. If a borrower misses a payment or makes a payment that is less than the minimum amount due, the loan balance will increase due to the addition of late fees and interest.

It is important for borrowers to understand the components of their loan balance and the repayment process in order to avoid increasing their total loan balance. By making timely payments and paying more than the minimum amount due, borrowers can reduce the amount of interest that accrues on their loan and pay off their loan faster.

Factors Contributing to Loan Balance Increase

When it comes to loans, there are several factors that can contribute to an increase in the total loan balance. Understanding these factors can help borrowers make informed decisions and take proactive measures to minimize the amount owed.

Interest Rates and Capitalization

One of the most significant factors that can increase a loan balance is the interest rate. When a borrower takes out a loan, the lender attaches an interest rate to the principal amount. This rate determines the cost of borrowing and can cause the loan balance to increase over time. Variable interest rates can be especially problematic, as they can fluctuate over the life of the loan, making it difficult for borrowers to predict their future payments.

Another factor related to interest rates is capitalization. This occurs when interest is added to the principal balance of a loan, increasing the total amount owed. Capitalization can occur in different ways, such as when a borrower enters repayment after a period of deferment or forbearance. It’s important for borrowers to understand when and how interest is being capitalized on their loans to avoid surprises down the road.

Fees and Penalties

In addition to interest rates, fees and penalties can also contribute to an increase in the total loan balance. Late fees, for example, can be assessed when a borrower misses a payment, adding to the amount owed. Other fees may be charged for things like loan origination or prepayment penalties, which can be costly for borrowers.

Deferment and Forbearance

Deferment and forbearance are options that allow borrowers to temporarily stop making payments on their loans. While these options can be helpful for borrowers who are experiencing financial hardship, they can also contribute to an increase in the total loan balance. During deferment or forbearance, interest may continue to accrue on the loan, which can then be capitalized when the borrower enters repayment. It’s important for borrowers to consider the long-term implications of deferment and forbearance before deciding to use these options.

Impact of Loan Management Strategies

When it comes to managing loans, borrowers have several strategies they can use to manage their loan balances effectively. In this section, we will explore some of the most effective loan management strategies that borrowers can use to reduce their total loan balance.

Making Extra Payments

One of the most effective ways to reduce your total loan balance is by making extra payments. By making additional payments, borrowers can pay off their loans faster, reduce the amount of interest they pay, and ultimately lower their total loan balance. Borrowers can make extra payments by increasing their monthly payments, making bi-weekly payments, or making lump-sum payments.

Loan Refinancing and Consolidation

Loan refinancing and consolidation are two other effective strategies that borrowers can use to reduce their total loan balance. Refinancing involves taking out a new loan to pay off an existing loan. By refinancing, borrowers can take advantage of lower interest rates and better loan terms, which can help them save money and reduce their total loan balance.

Loan consolidation involves combining multiple loans into a single loan. By consolidating their loans, borrowers can simplify their loan payments and potentially reduce their interest rate, which can help them pay off their loans faster and reduce their total loan balance.

Budgeting and Financial Planning

Another effective loan management strategy is budgeting and financial planning. By creating a budget and setting financial goals, borrowers can better manage their loan repayment strategy and ensure they are making their loan payments on time. Additionally, by setting financial goals, borrowers can work towards paying off their loans faster and reducing their total loan balance.

Navigating Changes and Challenges

When it comes to loans, navigating changes and challenges can be a daunting task. However, being aware of the potential challenges and knowing how to handle them can make a big difference in the long run. Lets discuss some of the changes and challenges that borrowers may face and how to navigate them.

Economic and Policy Changes

Economic and policy changes can have a significant impact on loan balances. For example, changes in interest rates can increase the total amount owed on a loan. Borrowers should keep an eye on economic conditions and policy changes that may affect their loans.

The COVID-19 pandemic has also brought about significant changes in the loan industry. Federal student loan debt, for example, has been subject to loan deferment and grace periods. Borrowers should stay informed about these changes and take advantage of them when possible.

Avoiding Default and Late Payments

Loan default and late payments can increase the total loan balance significantly. Borrowers should make every effort to avoid default and late payments. One way to do this is by setting up automatic payments. This ensures that payments are made on time and reduces the risk of late payments.

Borrowers who are struggling to make payments should contact their lenders as soon as possible. Many lenders offer deferment or forbearance options that can help borrowers avoid default.

Frequently Asked Questions

How does interest accrual affect my loan balance over time?

Interest accrual is the process by which interest on a loan is calculated and added to the principal balance. The interest rate is applied to the outstanding balance of the loan, and the resulting amount is added to the principal. Over time, the interest accrual can lead to a significant increase in the total loan balance. Borrowers should be aware of the interest rate on their loans and how it will affect their repayment over time.

What factors can lead to an increase in my loan balance?

Several factors can lead to an increase in a loan balance. These include interest accrual, late fees, penalties, and other costs associated with the loan. Additionally, if a borrower defers payments, the interest may continue to accrue, leading to a higher total loan balance. Borrowers should carefully review the terms of their loan agreements to understand the factors that can contribute to an increase in their loan balance.

Can deferring my loan payments result in a higher total loan balance?

Deferring loan payments can result in a higher total loan balance. When payments are deferred, the interest continues to accrue, which can lead to a higher balance over time. Additionally, some loans may have a capitalization feature, which means that the unpaid interest is added to the principal balance. This can result in a higher total loan balance when payments resume.

In what ways does capitalization contribute to loan balance growth?

Capitalization is the process by which unpaid interest is added to the principal balance of a loan. This can occur when a borrower defers payments or enters a forbearance period. When the interest is capitalized, it becomes part of the principal balance, which can lead to a higher total loan balance. Borrowers should be aware of the capitalization feature on their loans and how it can affect their repayment over time.

How do different repayment plans impact the total balance of a loan?

Different repayment plans can impact the total balance of a loan. For example, if a borrower chooses an income-driven repayment plan, the monthly payments may be lower, but the repayment period may be longer. This can result in a higher total loan balance over time due to the accrual of interest. Borrowers should carefully review the terms of their repayment plans to understand how they will impact their total loan balance.

What should I understand about loan balance increases during entrance counseling?

During entrance counseling, borrowers are informed about the terms of their loans and how they will impact their repayment over time. This includes information about interest rates, repayment plans, and the factors that can lead to an increase in the total loan balance. Borrowers should carefully review this information to understand how to manage their loans effectively and avoid unnecessary increases in their loan balance.